M&a Big Data Platform - Deep data mining

M&a Big Data Platform - Deep data mining

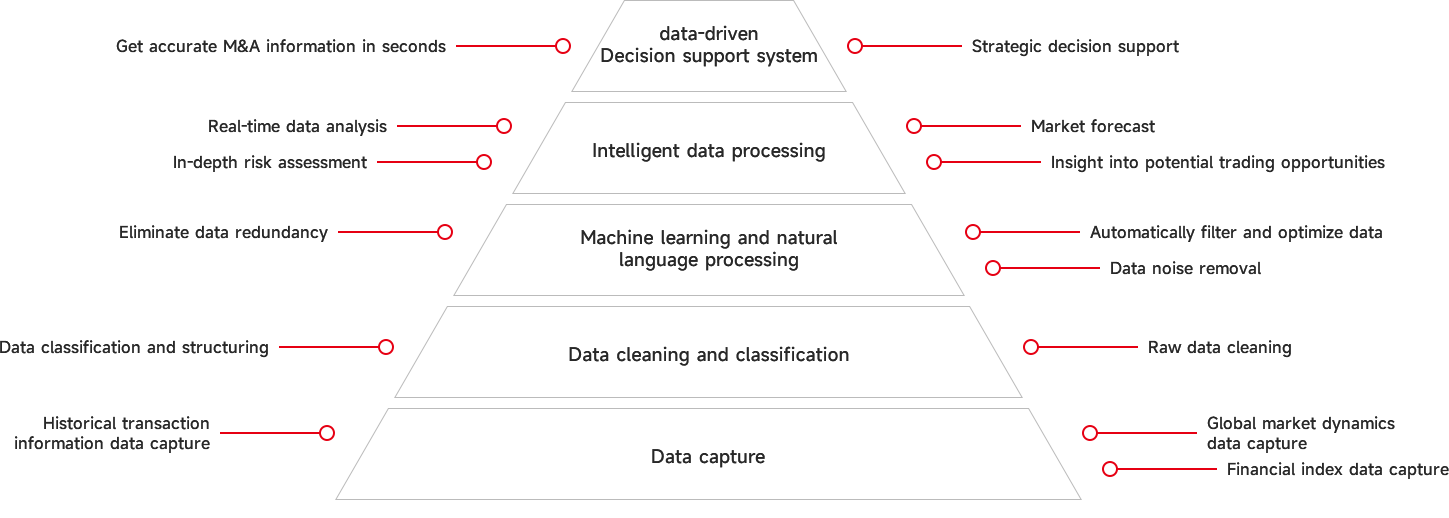

MergersDB (M&A Big Data Platform) is a cutting-edge intelligent data engine designed for M&A transactions around the world, with cutting-edge data processing capabilities to capture accurate M&A information in seconds to make data-driven strategic decisions in complex global market environments.

The platform utilizes advanced artificial intelligence technology and big data processing capabilities to quickly assemble large and complex data sets from around the world, including market dynamics, financial metrics and historical transaction information. With a powerful data scraping, cleaning, and categorizing engine, the platform can turn complex raw data into structured, high-value business insights.

The platform combines efficient machine learning algorithms and natural language processing technology to automatically filter and optimize data, remove noise and eliminate redundancy, and ensure data accuracy and timeliness. Its intelligent data processing module analyzes data trends in real time, providing in-depth risk assessments, market forecasts and insights into potential trading opportunities.

Target evaluation intelligent model

Target evaluation intelligent model

Target Valuation AI (Target Valuation Intelligent Model) combines the world's leading M&A theory with modern technology and is designed to handle complex M&A transactions. This model integrates the discounted cash flow model (DCF), Market Multiples, Transaction Multiples and other classical evaluation methods. Advanced theories such as Real Options Analysis and Economic value-added Model (EVA) are further integrated to form a multi-dimensional comprehensive evaluation framework.

The model uses advanced methods such as Monte Carlo Simulation and Scenario Analysis to analyze and deal with complex risks and uncertainties in depth, providing decision-makers with comprehensive risk assessment and trend prediction. Using machine learning and big data analytics, M&A Valuation AI is able to extract key insights from massive amounts of historical transaction data, market dynamics and financial information to accurately identify the key drivers of M&A success and valuation.

The model also takes into account strategic factors such as market entry, technology acquisition, and synergies to provide a comprehensive and dynamic valuation perspective. Target Valuation AI provides powerful intelligent support for decision-making, making informed decisions in complex M&A environments, maximizing the long-term value and success rate of transactions, and ensuring the strategic success of M&A transactions.